Introduction

PTFE (polytetrafluoroethylene) is a high-performance fluoropolymer produced by the polymerization of tetrafluoroethylene (TFE) monomers. Owing to its extremely low coefficient of friction, excellent chemical resistance, broad thermal stability (–200°C to +260°C), and superior electrical insulation properties, PTFE is widely used across industries—from advanced manufacturing to household products.

This report provides a detailed analysis of the PTFE market in 2025, focusing on price trends, demand structure, application segments, and the competitive positioning of major manufacturers.

Global Market Size and Growth Forecast (2022–2025)

The global PTFE resin market has evolved as follows:

| Year | Global Market Size (Billion USD) | Growth Rate (CAGR) |

|---|---|---|

| 2022 | Approx. 3.01 | — |

| 2023 | Approx. 3.26 | +8.3% |

| 2024 | Approx. 3.45 (est.) | +5.8% |

| 2025 | Approx. 3.68 (forecast) | +6.7% (2022–25) |

Key growth drivers include:

- Rising demand for high-performance insulating materials due to semiconductor and electronics miniaturization

- Increased use of chemically resistant and high-temperature materials in chemical plants and energy-related facilities

- Strong reliability in medical applications such as vascular catheters and implants

Market Price Trends (2022–2025)

As a high-performance resin, PTFE maintains higher price levels than most engineering plastics.

| Year | Average Price in Asia (USD/ton) | Remarks |

|---|---|---|

| 2022 | 8,500–9,000 | Primarily China & Japan |

| 2023 | 9,200–9,800 | Driven by FX fluctuations and rising raw material costs |

| 2024 | 9,000–9,400 (est.) | Transition toward stabilization |

| 2025 | 9,300–9,600 (forecast) | Stable raw material supply; growth in high-performance applications |

Key pricing factors include supply–demand balance of TFE monomers, energy price fluctuations, and tightened export regulations in major producing countries.

Market Trends by Application

While PTFE serves a wide variety of applications, the following four sectors represent the primary demand drivers:

1. Electronics and Semiconductor Sector

Thanks to its high-frequency performance and excellent insulation properties, PTFE is used in 5G communication devices, flexible printed circuits (FPCs), and printed wiring boards (PWBs). It is essential for advanced packaging technologies.

2. Chemical Plants and Piping Systems

PTFE shows robust demand as lining materials and gaskets in highly corrosive environments. It is also used in cleanroom-compatible applications.

3. Medical Sector

PTFE’s biocompatibility, flexibility, and chemical stability are valued in artificial blood vessels, catheters, and stents.

4. General Industry and Consumer Goods

Applications include frying pan coatings (Teflon™), low-friction films, and sliding components, maintaining strong consumer product demand.

Regional Analysis

| Region | Market Share (2025 Forecast) | Notes |

|---|---|---|

| Asia-Pacific | Approx. 52% | High production concentration in China, Japan, and South Korea |

| North America | Approx. 22% | Strong demand in medical and chemical applications |

| Europe | Approx. 19% | Significant use in semiconductor equipment and RF components |

| Other Regions | Approx. 7% | Emerging demand in South America and the Middle East |

In particular, China is expanding TFE monomer production capacity, contributing to higher self-sufficiency and price stabilization.

Major Manufacturers and Market Share

Global market share estimates for 2025 are as follows:

| Manufacturer | Estimated Share (%) | Country |

|---|---|---|

| Chemours (formerly DuPont) | Approx. 20% | United States |

| Daikin Industries | Approx. 17% | Japan |

| 3M (Dyneon) | Approx. 12% | United States |

| Gujarat Fluorochemicals | Approx. 10% | India |

| Solvay | Approx. 9% | Belgium |

| Other (mainly Chinese producers) | Approx. 32% | China |

Key industry developments:

- 3M plans to exit PFAS-related products by the end of 2025 due to stricter PFAS regulations in the U.S.

- Chinese manufacturers are expected to increase their market presence through improved production technologies and cost competitiveness.

Technology Trends and Competing Materials

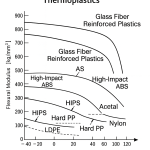

Low-Friction / Wear-Resistant Grades

Reinforced PTFE materials—such as carbon fiber and glass fiber–filled grades—are gaining adoption for sliding and wear-resistant applications.

Microporous Films and Fine Powder Grades

Microporous PTFE membranes (e.g., Gore-Tex®) are widely used in waterproof–breathable materials and battery separators.

Competing Materials

- PFA and FEP (other fluoropolymers): Offer greater transparency and processability

- PEEK and PPS: High stiffness and heat resistance make them viable alternatives in certain applications

Sustainability and Recycling Trends

While PTFE is chemically very stable, it can generate hazardous PFAS compounds during thermal decomposition, making environmental compliance and recycling technologies increasingly important.

- Urgent need for compliance with PFAS regulations in the EU

- Development underway for chemical recycling technologies enabling high-purity PTFE recovery

Market Outlook Beyond 2026

- Growth in semiconductor reinvestment is expected to drive demand for ultra-high-purity PTFE

- Medical applications may expand further as regulatory conditions improve

- Increased production from Chinese manufacturers may introduce oversupply risks in some regions

- From an ESG perspective, the transition toward non-PFAS fluoropolymers is beginning to gain attention

Conclusion

PTFE resins, known for their exceptional chemical resistance, heat resistance, and low friction properties, are expected to continue growing—particularly in the electronics, chemical, and medical sectors—throughout 2025. However, adapting to environmental regulations and the emergence of competing high-performance materials will be essential for maintaining long-term market competitiveness.

Continuous monitoring of market trends, alongside portfolio optimization and technology innovation, will be crucial for securing global competitive advantage.

This report integrates multiple industry research datasets, market statistics, and government publications to provide a comprehensive analysis of the global PTFE resin market in 2025.